In my 2/12/17 blog post, I traced the flow of money into apartment buildings and how everything ultimately translates to the monthly expenses incurred by residents (rental tenants, condo owners and co-op shareholders). Interestingly, when we accounted for everything including taxes and mortgage payments if any, monthly differences look tiny. Variations were in how much you pay up front; nothing for a rental (aside from costs associated with establishing the tenancy), a bunch for a co-op, and a lot more for a condo. So why not just rent? Why would anyone ever want a condo? Control over one’s space matters but in terms of money, it all comes down to the E-word; “equity.”

The Obvious Way to Make Money in Real Estate

Buy low and sell high! That was easy.

One way that can and does happen is to buy an investment, a property, a house, a co-op, a condo, that can increase in value due to improvement in the property (the classic fix-and-flip), increase in desirability of the neighborhood (gentrification), etc. Or as has been the case for much of the past 30-plus years, real estate has gained value from the passage of time.

Actually, most gains have occurred due to the passage of time. And to get real, it wasn’t really the passage of time per se. Inflation, thought by many to be an important driver of real estate prices, has been low and falling for much of the period. What really happened was an epoch decline, collapse actually, in interest rates generally and mortgage rates in particular.

The lower the mortgage rate, the higher the value of a property all else being equal. Let’s say you want to buy a house and pay $2,000 per month for your mortgage. If rates are 8%, assuming a 20-year mortgage and 20% down, that means you can spend $300,000. But if rates fall to 4%, a buyer with the same $2,000-per-month payment threshold

will be able  to pay $410,000 for the same property in the same condition and get approved for a loan under the same set of credit-evaluation standards. Moreover, you can bet that market forces (good old Economics 101; supply and demand) will make sure your buyer in the 4% word does pay $410,000 no matter how much he or she squawks about how you only had to pay $300,000 for the same property back in the day.

to pay $410,000 for the same property in the same condition and get approved for a loan under the same set of credit-evaluation standards. Moreover, you can bet that market forces (good old Economics 101; supply and demand) will make sure your buyer in the 4% word does pay $410,000 no matter how much he or she squawks about how you only had to pay $300,000 for the same property back in the day.

The Future Won’t Be the Same

In the past generation, some who built real estate wealth did so through improved valuations for the property and/or the neighborhood, but most did it through the collapse in interest rates.

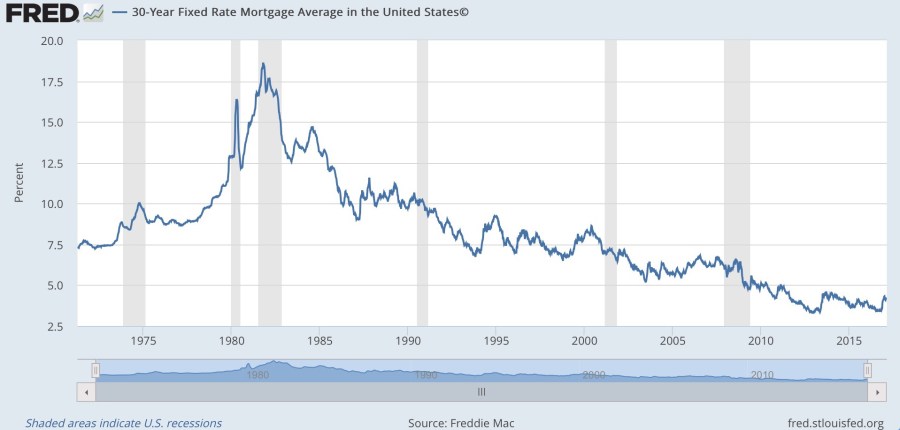

Going forward, there remain ample opportunities to profit from improvements in desirability of properties and/or locales. But one thing is clear. Mortgage rates have bottomed (see Figure 1) so the bold declines that had benefitted so many real estate owners and investors so handsomely in the past cannot continue to operate in the future.

Figure 1 – Mortgage Rates Over the Years

At first glance, this looks discouraging. The easy way to make money in real estate – sit back and profit from the collapse in mortgage rates – is gone. Now, we have to resort to the hard way, to find properties capable of benefitting from improved regard in the marketplace or do the grunt work to make them better.

Good news: There still is one easy-way scenario to build equity that will continue to work. Even if you don’t get a higher price, you can still retroactively reduce your cost by paying down your mortgage. Strictly speaking, you are altering your “investment” by reallocating debt capital to the equity side. But you need not worry about the jargon. What’s important is to recognize that your potential for profit grows with every mortgage payment you make.

Build Equity by Paying Your Mortgage

Each monthly payment goes partly to payment of interest and partly toward repaying principal. The amount allocated to each varies over time with more of the early payments going toward interest. As you reach the latter stages of paying down, you’re paying less and less interest and more principal. Don’t even try to memorize the details. Nobody does that. You can get all the specifics you need from widely available on-line mortgage calculators available through such web sites as Streeteasy.com or Bankrate.com or if you’re a spreadsheet geek, by working with Excel’s pre-built PMT and IPMT functions.

Each monthly payment goes partly to payment of interest and partly toward repaying principal. The amount allocated to each varies over time with more of the early payments going toward interest. As you reach the latter stages of paying down, you’re paying less and less interest and more principal. Don’t even try to memorize the details. Nobody does that. You can get all the specifics you need from widely available on-line mortgage calculators available through such web sites as Streeteasy.com or Bankrate.com or if you’re a spreadsheet geek, by working with Excel’s pre-built PMT and IPMT functions.

What I want to do here is illustrate what happens over time as you pay down a mortgage. I’ll return to the make-believe building I described in my 2/12/17 post, the one at 123 Anyplace Ave. and examine what happens over time to your “balance sheet,” the measure of your personal wealth, as a result of renting an apartment, owning a condo unit and owning co-op shares. Here is a summary of the basics.

Table 1

| Renter | Condo Owner | Co-op Shareholder | |

| Monthly Cost $ | 2,380.95 | 2,249.72 | 2,249.72 |

| Total Investment | 0.00 | 140,000 | 70,000 |

| Initial Cash Outlay | 0.00 | 42,000 | 21,000 |

| Mortgage Debt | 0.00 | 98,000 | 49,000 |

If you are not looking for any investment at all, then the condo and co-op columns are out of play. Your situation is clear and simple on day one; pay the monthly rent and accept no other obligations, baggage, red tape, etc. If you want or need flexibility to walk out whenever you want (assuming you wait till lease expiration or find a way to exit during the middle of the term, which is usually do-able), renting is the way to go.

But if you have the lifestyle and financial wherewithal to accept some sort of commitment, even if for less-than-forever (co-ops and condos are sold all the time), here’s what you can gain, above and beyond the modestly lower monthly outlay (to eliminate the landlord’s profit).

Table 2

| Condo | Co-op | |||

| Your Debt $ | Your Equity $ | Your Debt $ | Your Equity $ | |

| Day One | 98,000.00 | 42,000.00 | 49,000.00 | 21,000.00 |

| After 5 Years | 82,915.51 | 57,084.49 | 41,457.76 | 28,542.24 |

| After 10 Years | 62,854.29 | 77,145.11 | 31,427.45 | 38,572.55 |

| After 15 Years | 35,796.12 | 104,203.88 | 17,898.06 | 52,101.94 |

| After 20 Years | 0.00 | 140,000.00 | 0.00 | 70,000.00 |

So after 20 years, the condo owner finds that his or her initial $42,000 investment has more than tripled as is worth $140,000 assuming market conditions stay the same. For a co-op shareholder, the value of an initial $21,000 investment would have risen to $70,000. The percentage gain is the same. The only difference is in the size of the equity stake.

Suppose the market collapses and real estate values plunge by 50%. Then the condo would still be salable for $70,000, which would amount to a 67% profit over the initial $42,000. For the co-op, a 50% collapse in real estate prices would amount mean a sale price of $35,000, 67% above an initial $21,000 investment.

Here are the percentage changes in equity values over different periods assuming constant conditions in the real estate market.

Table 3

| Total Gain,

Start to Finish |

Annual Rate

of Return |

|

| After 5 Years | 35.9% | 6.3% |

| After 10 Years | 83.7% | 12.9% |

| After 15 Years | 148.1% | 19.9% |

| After 20 Years | 233.3% | 27.2% |

Perhaps you can’t imagine yourself staying put for 20 years. That would be understandable. We live in a changing increasingly mobile society. But even the five- to 10-year returns are pretty good considering many alternatives. And if you’re willing and able to take on a bigger monthly, you can use a mortgage that matures in less than 20 years, which means you reach your full equity stake more quickly.

That’s an impressive plan to building equity. And to borrow a line from the world of infomercials: But wait, there’s more . . .

Don’t Forget the Monthlies

We’re not dealing here with pork-belly futures, currency options, or even dividend-paying stocks. This is about residential real estate, your home. No matter what form of living you choose and no matter what sort of investments you have, you have to live somewhere and that is going to cost you something.

So don’t just compare the 6.3% annual equity rate of buildup you’d look at with a five-year time horizon to a dividend stock yielding 6.3%. (Actually, under today’s capital-market conditions, a 6.3% dividend yield would be considered high and that means above-average risk). If you invested $21,000 into a dividend stock, that could turn out OK as far as the stock goes (assuming none of the risks jump up to bite you). But you still need to come up with about $2,300 per month for a place to live and that monthly would contribute nothing to growth of your $21,000 stock position.

So don’t just compare the 6.3% annual equity rate of buildup you’d look at with a five-year time horizon to a dividend stock yielding 6.3%. (Actually, under today’s capital-market conditions, a 6.3% dividend yield would be considered high and that means above-average risk). If you invested $21,000 into a dividend stock, that could turn out OK as far as the stock goes (assuming none of the risks jump up to bite you). But you still need to come up with about $2,300 per month for a place to live and that monthly would contribute nothing to growth of your $21,000 stock position.

With a co-op, however, your inevitable monthly housing expense (about $2,300 I’m assuming) will contribute directly to your equity build-up. And you get a bonus after the mortgage is paid off. Here’s what your monthly expense looks like at that time.

Table 4

| Renter | Condo Owner | Co-op Shareholder | |

| Years 1-20 | 2,380.95 | 2,249.72 | 2,249.72 |

| Years 21 and beyond | 2,380.95 | 1,898.67 | 1,547.62 |

The difference between the rental value of the apartment and what you pay after eliminating your mortgage is real, significant, and a bonus above the basic equity build-up. Invest that monthly difference even in something safe like bank CDs, and you’re really doing well.

But Wait, There’s More

To this point, we haven’t considered personal taxes. That, too, is relevant, and in a good way. OK. Taxes aren’t usually considered a good thing. But assuming they are inevitable – and they are – they can operate to add further to the benefits of condo or co-op ownership. That will be the addressed in my next blog.

One thought on “The Great Home Equity Buildup”